There are plenty of ways to keep a watchful eye on your business’s success. Customer Lifetime Value (CLV) is among the most valuable for two reasons:

- It gives you a snapshot of customer spending right now

- It sets your expectation for earnings into the future

All in one neat metric.

Let’s start by getting on the same page – what exactly is Customer Lifetime Value?

In this post:

- What is Customer Lifetime Value?

- How to calculate your CLV

- Avoid these common CLV blunders!

- 4 strategies to increase your CLV

What is Customer Lifetime Value?

CLV is the amount of profit a typical customer generates in the entire time they remain a customer. (It’s also known as ‘LIfetime Value’ or ‘LTV’)

CLV combines information on acquisition costs, retention rates and customer spend. That’s crucial information for forward planning.

Unlike metrics like CSat or NPS, CLV relates directly to profitability (so it tends to be important to more people!)

How to calculate your CLV

The complexity of your CLV calculation depends on the complexity of your business model.

Here’s and example: a subscription service like Spotify costs $10 per month and has few additional services to sell. As a result, practically every customer generates $120 per year of revenue.

With that information in mind, Spotify only needs to know a few more things:

- How long does the average customer stay with Spotify?

- What’s the cost of acquiring that customer?

- What’s the cost of serving that customer?

- How much of that $120 p.a. revenue is profit?

The calculation will look like this:

This calculation can work for any business. But, if you don’t operate on a subscription basis it’s harder to define how long a customer typically stays loyal.

A common solution is to define a maximum period between sales that counts as a retained customer. So if you sell apples, you might expect a retained customer to purchase from you at least once per month.

Avoid these common CLV blunders!

There are a number of ways that businesses mess up the CLV calculation.

Don’t worry, it’s easily done! Here are some hazards to avoid.

#1 Don’t look at revenue, look at *profit*

Spotify may generate a consistent $120 p.a from the typical customer… but the company has never turned a profit!

It’s vital to consider whether the money coming from a customer covers the costs of service and acquisition.

#2 Don’t stop measuring!

Something about the word ‘lifetime’ tends to make businesses think CLV is static.

It’s not.

All kinds of factors will impact the lifetime value of your customers. It’s especially important to re-measure after big changes! They could be product launches, major marketing campaigns and service updates.

#3 Don’t go ‘one size fits all’

Spotify’s simple product may mean there aren’t many ‘types’ of customer. But that’s rarely the case for other businesses!

You’ll need to group customers based on factors that impact their CLV. These can include the likelihood of full retention (based on factors like age), the acquisition cost and the value of their purchases.

9 strategies to increase your CLV

As we’ve seen, increasing your CLV comes down to three things; improving customer retention, raising the average customer spend and cutting cost to serve.

It’s typically option 2 – increased spend – that gets businesses most excited. It also tends to be the hardest one to achieve, especially in a sustainable way!

Here are a few simple (dare I say ‘foolproof’?) methods to boost your CLV.

Create a hassle-free onboarding experience

The benefit? Increased retention

Onboarding is most relevant to online tools and platforms. (But all businesses depend on it to some degree.)

Improving your onboard is a crucial first step. Almost a quarter of customer churn is driven by weak onboarding experiences.

A strong onboarding experience is:

- Succinct

- Easy to navigate

- Customer-focused (i.e. it’s driven by what the customer needs, and not what you need)

The single biggest error businesses make is overloading customers. The best onboarding practices give just enough information to let the customer get started.

#1 Dropbox focuses on interactivity. New users are asked to upload a single file, which shows the customer how simple the product is to use.

#2 DuoLingo keeps it short. The language-learning website asks for minimal infor from new customers. They ask for detail later on, once the customer is embedded.

#3 LinkedIn visualizes progress. A simple, visual representation of the new business user’s progress through setup makes clear how much input is needed.

Boost upselling and cross-selling

The benefit? Higher spend-per-customer

The good news is that if you can hold on to your existing customers, they’ll tend to spend more over time. (In fact, loyal customers spend around 67% more per transaction than new customers.)

But you don’t want to rely on ‘time will tell’ approach do you?

Good upselling and cross-selling is:

- Tailored to the customer

- Timely

- Focused (i.e. don’t overwhelm customers with choice)

The key mistake businesses make when upselling or cross selling is offering too much. A targeted offer has far more impact.

#4 Amazon sneakily demonstrates value. The masters of cross selling don’t say ‘you might like this’. They say ‘other people liked this’ which is a form of social proof.

#5 Dollar Shave Club keeps prices low. These guys live for the cross sell. Their basic kit is famously cheap, which creates leads – but most customers end up with a premium package.

#6 EasyJet makes everything a product. As a budget airline, EasyJet can’t upsell with first class tickets. Instead, they offer customers the chance to select their seat… for a price.

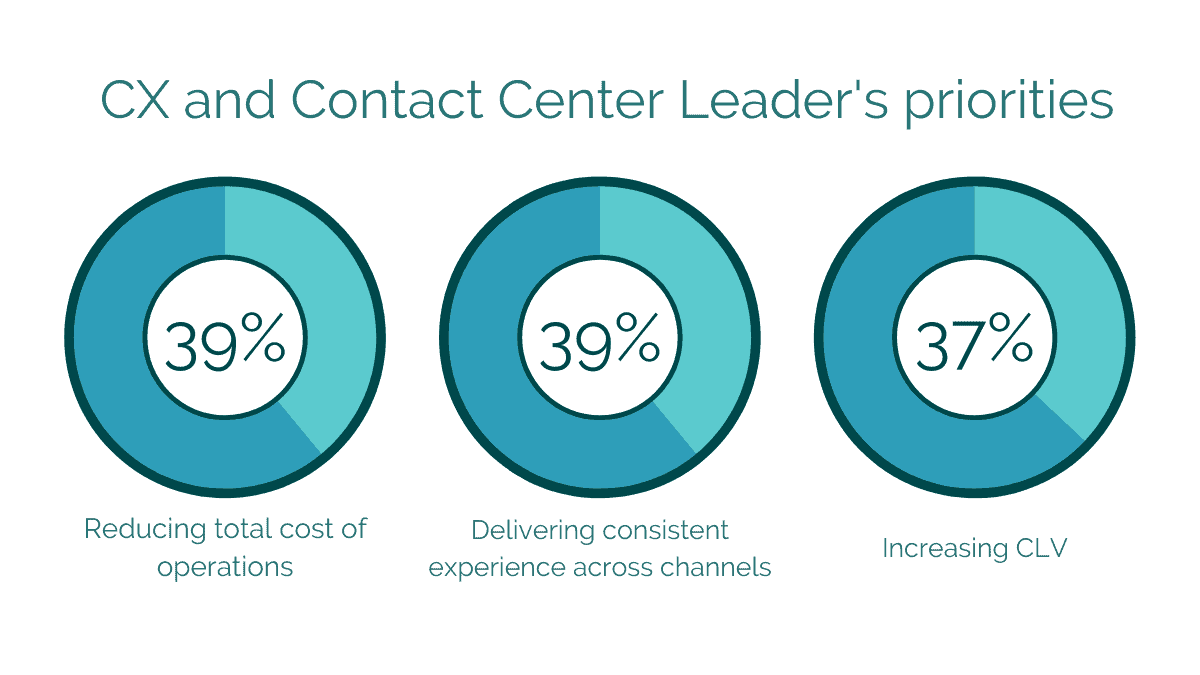

Cut cost-to-serve with automation

The benefit? Higher profitability per customer

Around 40% of contact centers say that reducing the cost of their operations is a key objective. No big surprise there.

What is surprising is the number of approaches businesses take to achieving this. There’s really just one game in town, and it’s automation.

Successful automation projects:

- Focus on simple, routine tasks

- Remain flexible to changing needs

- Understand the context of service enquiries

The major mistake businesses make with automation is deploying systems which they cannot easily alter. That’s why No-Code automation products tend to be far more successful.

#7 Delta saves $$$ with automated voice. The airline introduced conversational AI in 2013 and uses it (very successfully) to solve customer queries and gather data.

#8 Anglian Water gets proactive. This UK water company sends automated outbound messages to keep customers informed during service disruption. It’s cheap, it’s manageable.

#9 SiteGround makes feedback easy. You need a lot of feedback before you can learn from it. Siteground makes this easy by profiling respondents, and automatically requesting… even more feedback!